![[object Object]](https://backend.disco.info/wp-content/uploads/2021/03/shutterstock_1438050506.jpg)

Broadcast News – An Untapped Source For Finding Alpha From Decomposition

· Mark Gatty Saunt

- News

- Algorithmic Traders/Blackbox Systems

- Alpha Generation

- Asset Managers

- Broadcast News

- Broadcast Transcripts

- CDOs

- CIOs

- Commodity Traders

- FX Traders

- Hedge Funds

Within the financial services sector, technology solutions that leverage natural language processing (NLP), machine learning (ML) and artificial intelligence (AI) to monitor news coverage are gaining in both utility and popularity. Firms are looking to embrace data and analytics to help drive increased risk-adjusted returns.

The use cases for these solutions fall largely into two categories: surveillance and decomposition.

Finding Alpha From Decomposition

Decomposition involves understanding and, quite literally, decomposing market dynamics, to understand which entities are involved in those dynamics and to what extent they are driving or adhering to market trends.

Decomposition is used to break down what’s happening that could affect the market; it’s used to find Alpha*, to manage client investment portfolios and to monitor or anticipate regulatory changes. It’s about using iterative analysis to examine market movements and decompose what’s driving them.

* Alpha Generation: Developing investment and portfolio management strategies with returns that exceed the market benchmark index as a whole. Learn more about Alpha at Investopedia.

Success with decomposition requires two important components – a steady, clean and comprehensive feed of timely news; and an analytics tool, that is capable of accurately separating ‘signals’ from the noise, enabling firms to generate more repeatable and scalable alpha.

This type of machine-readable and actionable data is imperative for Chief Data Officers (CDOs) who are responsible for supervision and ownership of data across their enterprise.

Using NLP For News Decomposition

For many financial services users with news decomposition use cases (e.g. those trading equities, commodities, FX etc.), state-of-the-art text analysis and NLP engines perform as the analytical tools, to process entities, extraction, enrichment, disambiguation, salience, key phrases, topic vectors and various sentiment assignment modules (including financial topics).

This is a powerful solution that is solving numerous unstructured text challenges within the financial services industry today.

| At a Glance: State of the Art Natural Language Processing (NLP) |

| Entity: A person, place, organisation, object, or concept |

| Extraction: Isolating an entity (person, place, date, event, etc.) in text |

| Enrichment: Adding metadata to an entity for further discovery |

| Disambiguation: Distinguishing one “Paris” from another using context |

| Sentiment: Use contextual models to assess positive or negative impact |

| Salience: Measures how important each entity is to the text |

| Key Phrases & Topic Vectors: Identify a topic or a grouping of words in text |

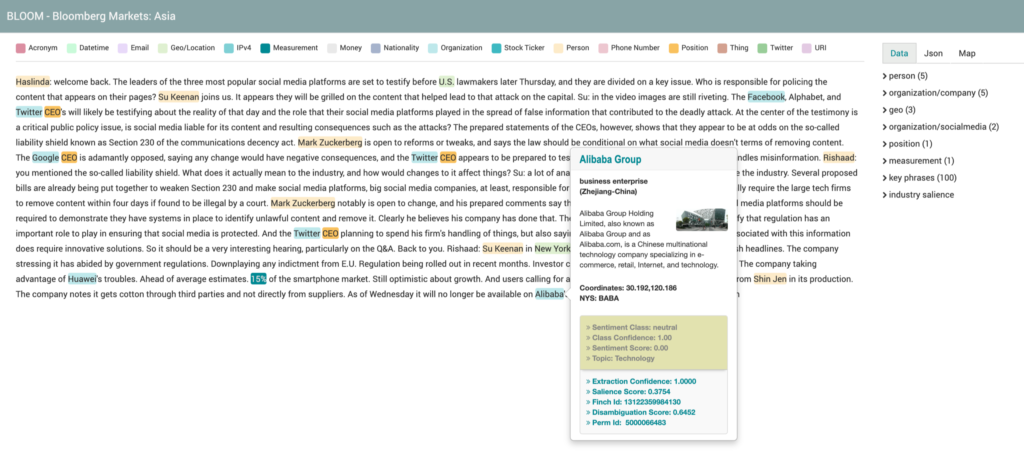

Example Enriched Transcript

Within the below example broadcast transcript, the following ‘enrichments’ are visible: Date & Time (3/25/2021 02:50:09 UTC); Station (Bloomberg); Market (U.S. Cable); Companies (Google, Alphabet Inc., Huawei, H&M, Alibaba Group); Tickers (NSM:FB, NYS:TWTR, SAO:GOOG34, NSM:GOOGL, STO:HM B, NYS:BABA); People (Haslinda, Su Keenan, Mark Zuckerberg, Rishaad Salamat, Shin Jen); Key Phrases (communications_decency_act, stock_markets, business_flash_headlines, government_regulations, bloomberg_markets); Sentiment Class (for Alibaba Group = Neutral); Class Confidence; Sentiment Score; Topic; Extraction Confidence; Salience Score; Disambiguation Score and more.

Who Benefits?

CDOs, CIOs, Market Data Teams, Research Teams, Quantitative Analysts, Portfolio Managers, Asset Managers, Institutional Investors, Algo Traders, Commodity Traders, FX Traders and other Professional Investors at Hedge Funds, Quant Funds, Investment Banks, Portfolio Management Firms, Currency & Commodity Brokerage Firms, Blackbox Systems etc.

Enriched Broadcast News Transcripts

Aggregated broadcast news content, in the form of fully enriched and cleaned transcripts, is a format for machine-produced news that has barely been tapped by the financial services sector (to assist with generating alpha).

This is because until now, those two important components for finding alpha from ‘decomposition’ (a steady, clean and comprehensive feed of broadcast news transcripts; combined with the right analytics tool) have not been readily available.

By using news that has been fully enriched, users can act on those all-important signals in their quest to find alpha.

When Speed + Analytics Matter, Turn To Broadcast News

When news timeliness is critical, broadcast news (machine produced transcripts) can deliver the news faster than non-broadcast news outlets can write, edit, process and deliver it.

The transcripts are produced by capturing between 2 to 5 minutes of a live broadcast segment. And within 2 minutes following the end of the captured segment, the transcript is produced, packaged into a ‘page’, fully enriched and delivered to end-customers.

Example: CNN Newsroom from 08:00 am EST – 08:05 am EST is processed and delivered to end-customers at 08:07 am EST.

BroadCast News Offering

SyndiGate, a leading content licensing and distribution agency specialising in news and data, now offers the financial services sector access to an expanding global offering of low-latency broadcast news transcripts, with high-quality entity extraction, disambiguation and enrichment (including multiple sentiment assignment modules, financial focused identification standards etc.).

The 24/7 data-as-a-service (DaaS) captures, processes and enriches the news from 2,690+ radio & TV stations all over the globe (10+ news languages), including all 210 designated market areas (DMAs) in the United States. The total daily volume of transcripts being processed currently equates to 700,000+ pages each day.

Users get access to coverage (breadth), content (entity enrichments and metadata), curation (fine tuning a personalised/custom feed) and analytics (NLP).

Delivery/Access

Market data, research and analytics teams at financial services firms get access (via FTP, REST API, Amazon Kinesis Data Firehose etc.) to a streaming feed, comprising the original transcript, station and program metadata, as well as a refined transcript, that is fully enriched with the entities mentioned, geospatial coordinates, key phrases and topic vectors.

Transcripts are drastically improved from their raw-form state (which is what most commercially available solutions would provide). All ads and filler content is removed; spacing issues that merge words are fixed; as are capitalisation issues that would affect extraction (e.g. “Case” as a last name versus simply the word “case”).

Personalised News Packages

News packages can be customised so that users receive a filtered and curated feed, comprising only the content they need.

Filters can be set up to deliver news that will assist with investment strategies focused on things like Aerospace/Defence, Absolute Returns, AI, Arbitrage, Biotech, Convertibles, Credit, Commodities, Crypto, Distressed Assets, Emerging Markets, Equities, Fixed Income, Global Macro, Index Funds, Insurance, FX, Long/Short, Managed Futures, Micro Cap, Multi Strategy, Private Equity, Real Estate, Small Cap, Technology and so much more.

Sample Workflow

1. Data Curation: A user sets parameters around what they’d like to see in their feed.

2. Sentiment: Sentiment models applied for a particular industry or lexicon.

Then, customers can use their feed for the following types of activities:

- Event Management: Thresholds are set to define “events” in news that are relevant to the user.

- Threshold Triggering: Events meeting a certain threshold create an alert for the user.

- Routing of Trigger and Alert Payload: Alerts are routed to individual users in an organisation.

- Evaluation of Relevance: End users evaluate an alert’s relevance with a click.

- Capture Results of Evaluation for ML: The rating is captured for automatic model tuning.

Even Predict The Direction Of Price Movement

Once the feed is filtered and curated, the entity sentiment can be used to predict the direction of price movement. Analysis that demonstrates this is available.

Early analysis of a single company (MSFT) has shown that our sentiment scores can predict the direction of price movement with 65% accuracy (and improving). More in-depth analysis will soon be available after looking at more companies, more stations and comparing against indexes.

In addition to the enriched broadcast news transcripts, SyndiGate’s Global News Offering comprises 193,000+ full text news sources from around the globe, in 200+ languages, from 195 countries, yielding approx. 3.7 Million stories per day.

Want to stay updated with the latest product news from SyndiGate? Simply add your email address to this form and hit Subscribe. We will only contact you with relevant information until you say otherwise.

![[object Object]](https://backend.disco.info/wp-content/uploads/2024/09/Honouring-Copyright-Holders--768x439.png)

![[object Object]](https://backend.disco.info/wp-content/uploads/2020/10/mel-poole-3IxYATx6Ylg-unsplash-768x511.jpg)

![[object Object]](https://backend.disco.info/wp-content/uploads/2020/09/Untitled-presentation-768x432.jpg)

![[object Object]](https://backend.disco.info/wp-content/uploads/2020/08/50170190977_2590543698_k-768x457.jpg)